The British Pound has seen mixed movements through the first three quarters of 2025, gradually recovering from the significant lows it experienced following the controversial “mini budget” introduced during Liz Truss’s tenure as British Prime Minister.

GBP/USD exhibited a strong uptrend driven by both the UK economy doing better than expected, thanks to somewhat unexpected dynamism in trade and the bearish narrative of the US Dollar through the year. Against the Euro, the pound faced pressure against due to the Eurozone’s relative economic resilience.

The relative stance of monetary policy is forecasted to keep the British Pound appealing to investors in Q4 and the beginning of 2026; however, the geopolitical context will be a decisive factor in whether the Pound benefits, especially in comparison to the Euro who gained strength recently due to capital flows away from the US Dollar.

Key British Pound (GBP) Forecast & Price Prediction Summary

- British Pound (GBP) forecast October 2025: For GBP/USD, analysts forecast the bearish dollar story dominating from October onwards and the pair ending the year towards the top of the 1.32-38 range. Although the 26 November UK budget is the big event for pound, the cleaner dollar bear trend tends to be the dominant factor at this point. The EUR/GBP is forecasted to remain well contained in a 0.86-87 range.

- British Pound (GBP) price prediction 2026: Analysts forecast the pound to continue its uptrend against the US Dollar towards 1,40, driven by a weaker dollar, improved global risk appetite and positive UK inflation data. Against EUR, the Pound if forecasted to decline towards 0.880-0.90 due to the positive sentiment around an upcoming fiscal stimulus, particularly in Germany.

- British Pound (GBP) forecast for the next 5 years: Looking beyond 2025, long-term forecasts are highly uncertain. Factors like the UK's economic growth, evolving UK-EU trade, and global economic shifts will be crucial. While some predict potential GBP strengthening with UK economic stabilization, risks like economic shocks and geopolitical instability remain. It is very important to understand that long-term predictions have very wide ranges.

With NAGA.com you can trade CFDs on GBP/USD, GBP/EUR, GBP/JPY, GBP/CHF, GBP/AUD, GBP/NZD, and GBP/CAD and with tight spreads using our award-winning trading platform and mobile apps.

Fundamental British Pound (GBP) Forecast Q4 2025

The UK is now seen the most stagflationary economy in the developed world: “A brutal mix of high inflation, weak growth, and rising unemployment," according to economists.

The next big moment for the BoE and for all sterling markets is the Autumn Budget, when the Finance Minister Rachel Reeves will present her budget on November 26. She is under pressure to stick to her own rules on borrowing to keep Britain's finances on track, as reflected in some of the large swings in yields on long-term UK bonds this year.

Bank of England to ease interest rate cuts in 2026

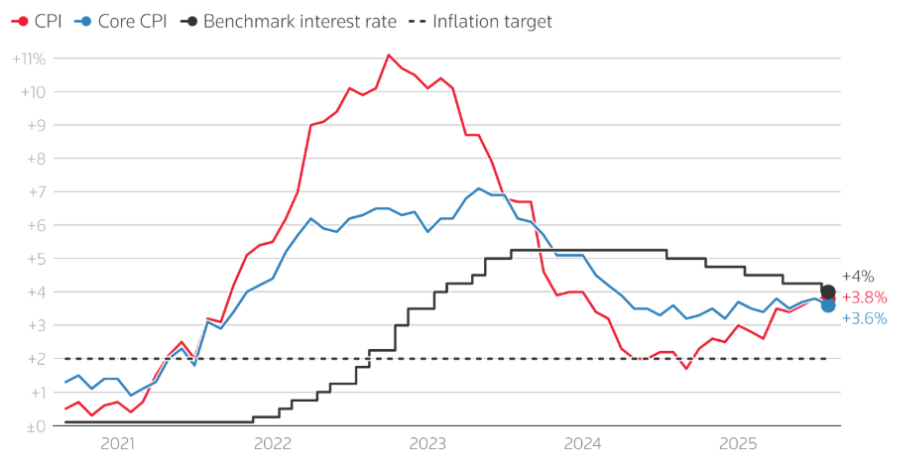

Several members of the Bank of England's Monetary Policy Committee have expressed caution about reducing interest rates too rapidly. However, the possibility remains for one more rate cut before the end of this year. Current projections estimate that interest rates will decline to around 3.75% by the close of 2025.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Heading into 2026, fewer cuts are anticipated as the Bank approaches a more neutral rate level. The expectation is for two additional reductions during 2026, eventually bringing rates to approximately 3.25% over the medium term. This reflects a careful balancing act between controlling inflation and supporting economic growth.

A mixed short-term outlook for GDP growth

Following an unexpectedly robust start, the UK economy is anticipated to experience slower growth through the latter half of 2025 and into early 2026, with GDP projected to rise by 1.2% in 2025 and 1.1% in 2026. This subdued pace reflects a combination of internal and external challenges, although some support is expected from lower interest rates and increased defense and infrastructure spending in both the UK and Europe. Despite falling borrowing costs, business investment growth is forecast to remain limited—around 1.9% for 2025—due largely to heightened global uncertainty and the effects of tax increases announced in the 2024 and anticipated 2025 Autumn Budgets. These factors weigh on business confidence and spending plans, tempering economic momentum overall.

Exports feel the force of US Tariffs

The recently announced US tariffs are anticipated to slow down trade between the UK and the US, causing subdued export activity for the remainder of 2025 and extending into 2026. While there was a noticeable surge in UK exports to the US early in 2025, this was mainly due to frontloading—the advancement of shipments to avoid higher tariffs. This resulted in a 23% increase in exports in March compared to the 2024 monthly average. However, by June, exports had declined sharply, falling to 21% below the 2024 average. The tariffs have disrupted supply chains and raised costs, leading to cautious trade behavior and weaker performance in the coming periods.

Inflation to peak at 4% this year

Inflation is projected to rise in the coming months and stay above the target level until late 2026. Recent increases in inflation have been primarily driven by domestic factors, including higher National Insurance Contributions and uncertainty linked to the Autumn Budget, pushing headline inflation to peak around 4% in autumn 2025 and maintain this elevated level through the rest of the year. Inflation is then expected to gradually decline from early 2026, with the Bank of England’s 2% target anticipated to be reached only in the latter part of next year. This forecast reflects continued cost pressures from regulated utilities, food prices, and wage growth, although easing energy costs and increased spare capacity in the economy are expected to contribute to inflation slowing down over time.

Pound to Dollar (GBP/USD) Fundamental Analysis and Forecast

Much of the pound’s upward trajectory has more to do with underlying dollar weakness than faith in sterling itself. This is supported by the sterling’s simultaneous depreciation against the euro, as the currency strength meter shows.

Earlier this year, U.S. President Donald Trump’s erratic trade policies unsettled investor confidence in American financial assets, which in turn raised market concerns about the potential for reduced reliance on the U.S. dollar globally.

While in UK markets price in around a 25% chance of a November rate cut and then in February and then on hold from there, in the US markets expect two further cuts this year. The Pound forecast is bullish due to the downward pressure on the US Dollar expected to persist as Fed rates move lower not only over the remainder of 2025 but into early 2026 as well.

When will interest rates go down?

Euro to Pound (EUR/GBP) Fundamental Analysis and Forecast

The Bank of England's more aggressive stance in August has clearly supported the EUR/GBP moving back into the 0.86-0.87 range, where it is likely to remain through the end of the year. However, the balance of risks appears tilted toward a potential rise. Eventually, the government is expected to implement stricter fiscal measures, wage growth and service prices are likely to ease, and the pound could face a more significant easing phase from the BoE than currently anticipated. This scenario is unlikely to unfold before the first quarter of 2026.

The European Central Bank has finished its easing cycle at 2.00%, but markets are still half-considering one final ECB cut. Any downside CPI surprises might hit the euro now.

The eurozone economy is expected to perform somewhat better than earlier anticipated, with growth revised up to 1.2% this year from 0.9%, though the outlook for 2026 is slightly softer at 1.0%. Though, the Euro to Pound forecast is bullish, with most price predictions pointing towards 0.90 in 2026. One potential bullish catalyst for the pound could be improved relations with the EU, particularly if it translates into more concrete action over time.

Pound to Yen (GBP/JPY) Fundamental Analysis and Forecast

The Bank of Japan kept its policy interest rate unchanged at 0.5% in its recent meeting, but hawkish sentiment has been rising as evidenced by two dissenting members voting for a rate increase. The surprise decision to begin selling exchange-traded funds (ETFs) and Japanese real estate investment trusts (J-REITs) signals a clear move toward policy normalization. Market expectations now increasingly point to October as the likely timing for Japan’s first-rate hike in this tightening cycle, marking a shift toward a more proactive stance amid moderate economic recovery and inflation pressures.

GBP/JPY has recently been fluctuating below the ¥200 psychological level, influenced by UK economic data showing mixed performance, alongside signals from the Bank of Japan about possible rate hikes, and the Yen’s traditional safe-haven appeal amid global uncertainties.

Moving forward, forecasts suggest Pound to Yen (GBP/JPY) will experience moderate volatility but with a gradual downtrend into late 2025 and 2026, influenced by divergent monetary policies, safe-haven flows, and economic developments in both the UK and Japan.

Technical British Pound (GBP) Forecast - Technical Outlook Q4 2025

The British Pound enters Q4 with a mixed sentiment. Technical price patterns combined with fundamental factors imply a cautiously optimistic outlook for GBP in 2025, but key resistance levels and volatility may create trading challenges.

Pound to Dollar (GBPUSD) Technical Analysis and Forecast Q4 2025

The technical analysis of the GBP/USD currency pair in 2025 reveals several key levels and patterns. Key resistance is at 1.3780-1.3800, while key support at 1.3180-1.3200.

The pair started a consolidation after failing to overcome the 1.38 area and is now showing a lower high. A lower low below the 1.32 area (previous swing high, 50-week MA and 38.2% Fibbo retracement) could send the price towards the 1.27 (the upside trendline started in 2022). If 1.34 holds, GBP/USD could test the 1.40 levels by the end of the year.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Here are some of the latest GBP/USD technical analysis and price predictions based on the chart pattern from different sources:

According to UoB there is still a chance, albeit not a high one, for GBP to test 1.3430. That said, this has to happen soon, or a break above 1.3565 would indicate that GBP remains in a range-trading phase.

InTouch Capital Markets said that GBP/USD continues to trade near the critical upside trendline at 1.3498, with a daily or weekly close below this level potentially leaving sterling vulnerable against the dollar.

Scotiabank forecast for the Pound is bearish; “A strong technical rejection of the peak above 1.37 casts a bit of a pall over the near-term GBP outlook.”

Support in the mid-1.34 range has held so far but weakness below 1.3440 trend on a sustained basis may see the pound slip back to the low 1.33s, according to the bank.

Euro to Pound (EURGBP) Technical Analysis and Forecast Q4 2025

In the bigger picture, the multi-year sideways pattern continues after the rebound from the key support area at 0.8250. The 2025 pattern shows a struggling uptrend, with higher lows below the previous swing highs. It will most likely force the 0.8750 level, and if it doesn’t hold, the EUR/GBP pair will target the 0.90 area at the end of 2025 – beginning of 2026.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

On the downside, a fake breakout should bring another leg down towards the 0.84 area.

Pound to Yen (GBPJPY) Technical Forecast

GBP/JPY shows a 3-month sideways pattern after breaking above the 200-mark price level.

The technical outlook for GBP/JPY appears neutral to upwardly biased, with the potential for a bullish move if the pair can decisively break above the key resistance levels at 200.

Past performance is not a reliable indicator of future results. All historical data, including but not limited to returns, volatility, and other performance metrics, should not be construed as a guarantee of future performance.

Conversely, the pair could continue its congestion toward the confluence of the 50-week MA and the upside trendline of the bullish trend started in 2020.

Only a break below this key confluence could lead to a bearish move.

British Pound (GBP) Price Predictions 2025 and Beyond

Here we look at the latest Pound forecasts for Q4 2025 and 2026, including comments from highly rated institutional FX strategists.

Bank of America forecasts GBPUSD to recover to around 1.41 by the end of 2025, driven by UK economic growth prospects and policy changes. However, there is a risk of it falling to around 1.21 in a downside scenario related to weaker UK fundamentals.

Morgan Stanley projects a 2025-year-end GBPUSD at 1.34 but declining to 1.20 in 2026 due to stronger US dollar and economic shifts.

Goldman Sachs revised its Pound to Dollar forecast and now predicts GBPUSD rising to 1.44 by end of 2026, contingent on improving UK macroeconomics and weaker USD trends.

Invesco forecast the Pound to continue its recovery after the lows following the 2022 controversial “mini-budget”, predicting a weakening of the US dollar alongside a slowing US economy and ongoing investor concerns about American fiscal and trade policies. The fund’s price prediction for EURGBP is 0.875 and 1.40 for GBP/USD by mid-2026.

According to RBC Brewin Dolphin, much of the pound’s upward trajectory is actually more to do with underlying dollar weakness than faith in sterling itself. They are bearish on Pound in the medium term and forecast GBPUSD at 1.30 in Q4 2025 – Q1 2026. For Euro to Pound they forecast a consolidation around 0.87 or within the 0.85-0.90 levels.

Pound (GBP) price predictions from AI-based websites

Panda Forecast predicts a moderate depreciation of GBP/USD, reaching 1.33 by the end of the year.

Long Forecast projects a slight decline in GBP/USD, reaching 1.32 by the end of 2025. However, the Pound to Dollar price prediction for 2026 is bullish with a price target above 1,40 and a high of 1.46 in May.

Wallet Investor forecasts a relatively stable but slightly declining GBP/USD towards 1.3200 by the end of the year. This AI suggests low volatility and a lack of a strong trend during 2026 also, with the Pound to Dollar forecasted to trade in range with a high at 1.3670 and a low at 1.3300.

Euro to Pound price predictions (EUR/GBP)

Long Forecast’s price prediction for the Euro to Pound rate is bullish, with the pair expected to close 2025 above the 0.89 price tag.

Wallet Investor predicts the pair to consolidate around 0.87 by the end of 2025 and continue its sideways movement during the entire 2026.

Pound to Yen (GBP/JPY)

Trading Economics forecasts the British Pound Sterling Japanese Yen to be priced at 183.70 by the end of this quarter and 198.501 in one year, according to its global macro models' projections and analysts' expectations.

Long Forecast expects GBP/JPY to close the year flat at 200, while Wallet Investor forecasts the pair to break this key resistance level and close 2025 at 203-204. They also forecast the Pound to Yen to advance as high as 215 during 2026.

What drives the GBP/USD Currency Pair

The EUR/USD trend depends on what stage of the cycle the global economy is at. During a recession, the demand for safe-haven assets, including the US dollar, increases. As a result, the pound/dollar goes down.

During a recovery from a recession, investors are not that focused on preserving money. Retail investors search for ways to multiply the deposit. At this stage, the fundamentals driving the GBP/USD currency pair are the GDP growth rates and the monetary policy of central banks.

A strong economy is a strong currency. The rapid rebound of GDP after the recession is a reason to buy securities of the country. In particular, the belief that the US economy will fully recover from the 2020 recession in the second quarter of 2021 and exceed its potential level in 2022 contributed to the USA 500 rally by 18% from January to early August. As a result of the capital inflow into the US stock market, the US dollar was strengthened.

The GDP rate is a tier-1 indicator but, unfortunately, lagging. The GDP report is published a month or month and a half after the end of the quarter. Therefore, it is very difficult to determine whose economy is growing faster at a particular time, which doesn’t provide a clear picture of the current economic situation to investors. That is why forex traders have to monitor some leading indicators, such as the US and UK PMIs.

The more the economy heats, the more likely the central bank to phase out the quantitative easing program and hike the interest rates. As a result, the assets denominated in the local currency grow more attractively. That is why the US dollar is currently strengthening against a basket of major currencies.

To understand the Fed’s intentions, one should track such economic indicators as inflation and unemployment rates. When these indicators reach the thresholds set by the Fed, the central bank starts scaling back monetary stimulus. In this case, the greenback will grow in value.

Speeches of central bank representatives are important in forecasting the GBP/USD exchange rate. The officials’ comments give a clue on how the central banks’ policies could change, and investors could develop trading strategies based on this.

Pound Forecasting and Trading Tips

Monitor the global financial markets. If the S&P 500 and oil are rallying up simultaneously, it is a reason to buy the Pound versus US Dollar. If the stock index is growing and the black stuff is falling in value, or both financial assets are depreciating, it may be relevant for traders to look for sell opportunities in the GBPUSD. A necessary condition to look for buy opportunities in the long term is the sync trends in the global economy. If the US GDP features robust growth, but the UK area faces problems, traders may look for sell opportunities. Use technical indicators in trading the GBP/USD to determine the current market state and key support/resistance levels. If the moving averages often cross the GBPUSD chart, the market is trading flat. If the price chart is above the EMA, the trend is bullish; if the price is below the indicator, the underlying trend is bearish. Use Japanese chart patterns and western chart patterns like head and shoulders, double top and bottom, or triangles to identify entry and exit points. Study the history of the financial asset’s quotes. An example that took place in the past may emerge in the future as a potential GBP/USD price movement. Do not try to use all popular trading strategies; you’d better find the one that suits you best. Always observe the rules of your online trading system.

Summary of Pound Price Predictions

GBP/USD, EUR/GBP, and GBP/JPY, are expected to be influenced by various factors including the Bank of England's interest rates, a bearish US Dollar, optimism about the implications of the coming fiscal boost in EU, and a bullish Bank of Japan. These factors will play a crucial role in shaping the Q4 2025 performance of the British Pound.

The British pound is labeled as “a currency that is struggling to regain its former glory” despite playing an “outsized role” in global foreign exchange markets. Looking at the key fundamentals of the UK, we can see some reasons to be upbeat on the outlook for the Pound in Q4 2025 and in the beginning of 2026, but there are challenges too.

It’s important to remember that any long-term forecasts, even the GBP/USD forecast, or any other currency pair, are too unreliable to believe in. Too many factors may affect the rate of the currency pair, and it’s best to be up-to-date with what’s happening in the global arena in order to make realistic and reliable predictions.

If you do decide that trading this currency pair is something for you, and you believe in the future of the British Pound vs. US Dollar pair, first, you need to decide on a suitable trading strategy for you and work it out first on a demo account, and then on a real account.

A great reason to open a trading account with NAGA.com! We provide a user-friendly trading app with an outlook for novices as well as experienced traders and investors.

Read also our daily and weekly updates on commodity and stock market:

- EURUSD forecast and price prediction

- Turkish Lira forecast and price prediction

- USD to INR forecast 2025, 2026, 2030

- AED to INR forecast 2025, 2026, 2030

- SAR to INR forecast 2025, 2026, 2030

- Gold forecast and price prediction

- Oil forecast and price prediction

- Dow Jones forecast and price prediction

- Nasdaq-100 forecast and price prediction

- Natural Gas forecast and price prediction

- Silver forecast and price prediction

Sources:

- British Pound - Quote - Chart - Historical Data - News (tradingeconomics.com)

- Bank of England pushes back on calls for early 2024 rate cuts | Snap | ING Think

- Will politics and policy spoil the Pound Sterling party? (fxstreet.com)

- Bank Of England To Stay On Hold Well Into 2024 (fitchsolutions.com)

- https://www.bankofengland.co.uk/monetary-policy-report/2024/february-2024